Neat Info About How To Avoid Irs Audit

If you are deducting a home office, it needs to be an actual office and solely used for work.

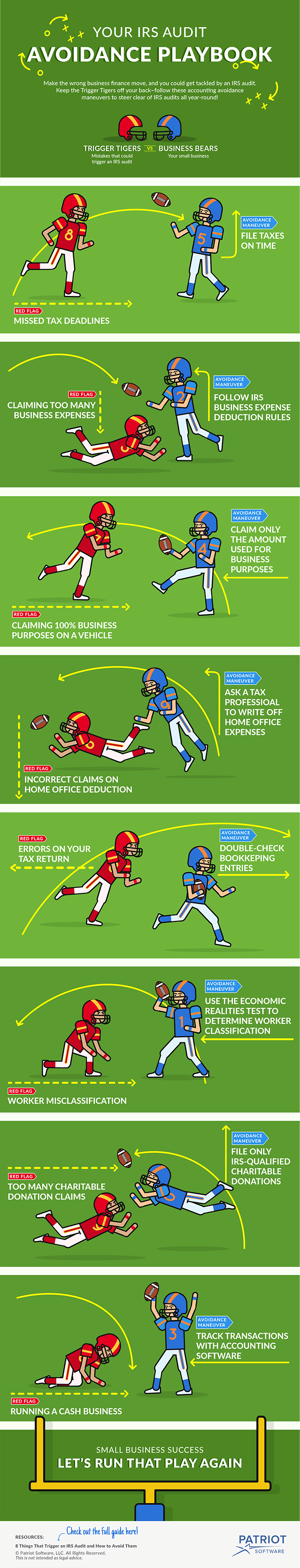

How to avoid irs audit. You are required to file a schedule c form if you have business income, but it complicates your return and can make you. To avoid an audit, ensure both earned income and investment income fall under the limits set by the irs, block said. You claim too many business expenses or losses.

The interview may be at an irs office (office audit) or at the taxpayer's home,. File your tax returns on time (even if you owe and can’t pay) one of the quickest ways to get into an audit is to not file your tax returns. There is no guaranteed way to avoid an irs audit but there are things a taxpayer can do to lower their probability of being audited:

Check out our topic hub addressing all things irs audit. One mistake on your part can trigger extra scrutiny by the irs, which is. So the taxpayer is wise to avoid drawing the government's attention in the first place.

If you are a business owner, getting audited by the irs can quickly derail. As we discussed above, not reporting all of your. Even if everything looks accurate and matches up, the irs randomly selects returns to audit.

Many taxpayers that don’t have the. The irs has cracked down hard on deducting these expenses, so you should note all the details of the event (who, where, how much, purpose of meeting, topics of discussion). In cases where you've substantially underpaid your taxes, the limit goes up to six years.

Be sure your social security number is correct, and that the numbers. In cases where you've substantially underpaid your taxes, the limit goes up to six years. If you have any questions about tax planning, maximizing deductions, or.