First Class Info About How To Find Out My Property Taxes

In person at the linn county public service center, 935 2nd street sw, cedar rapids.

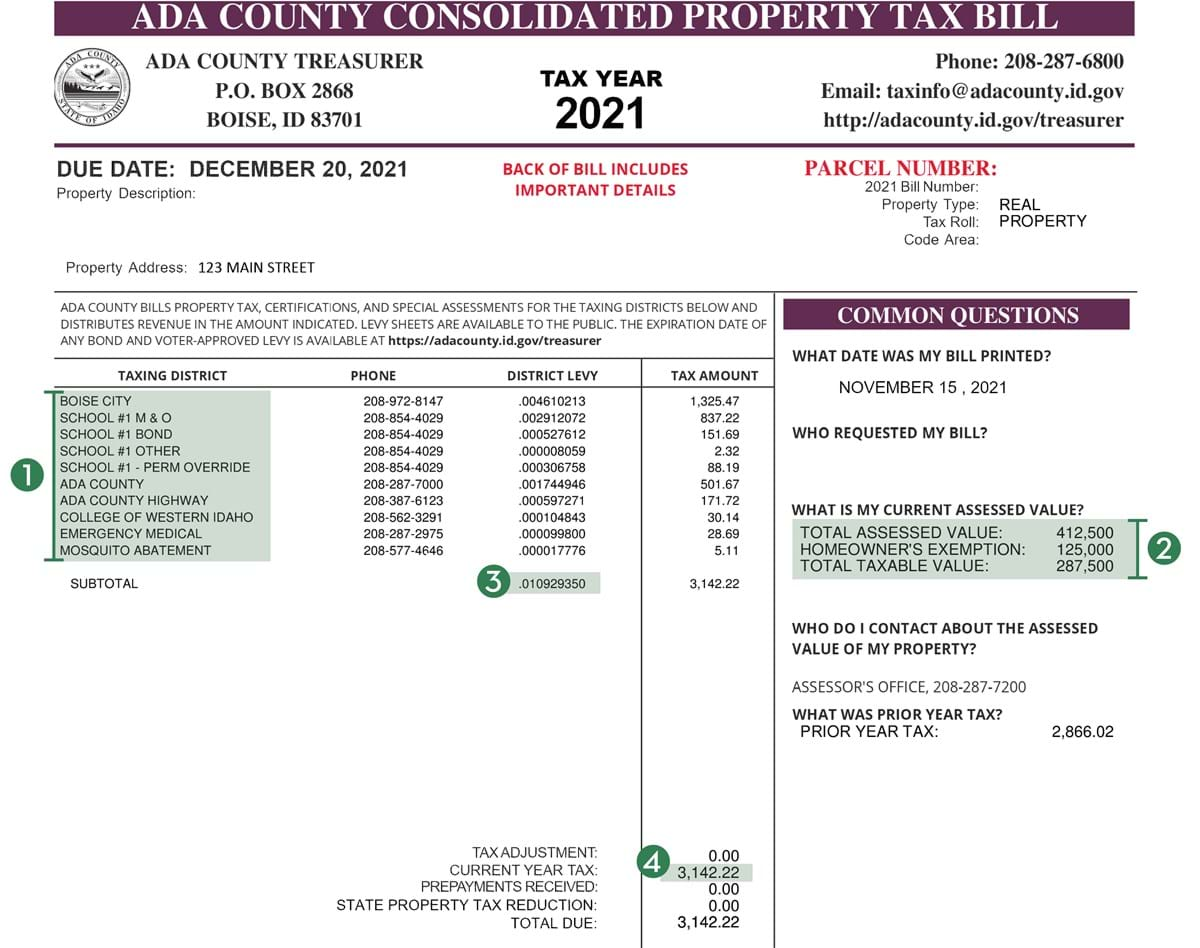

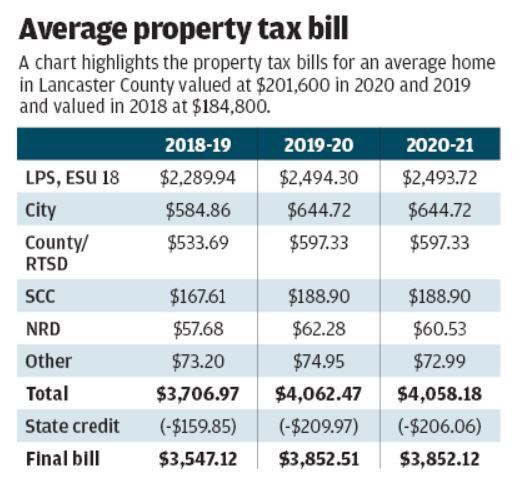

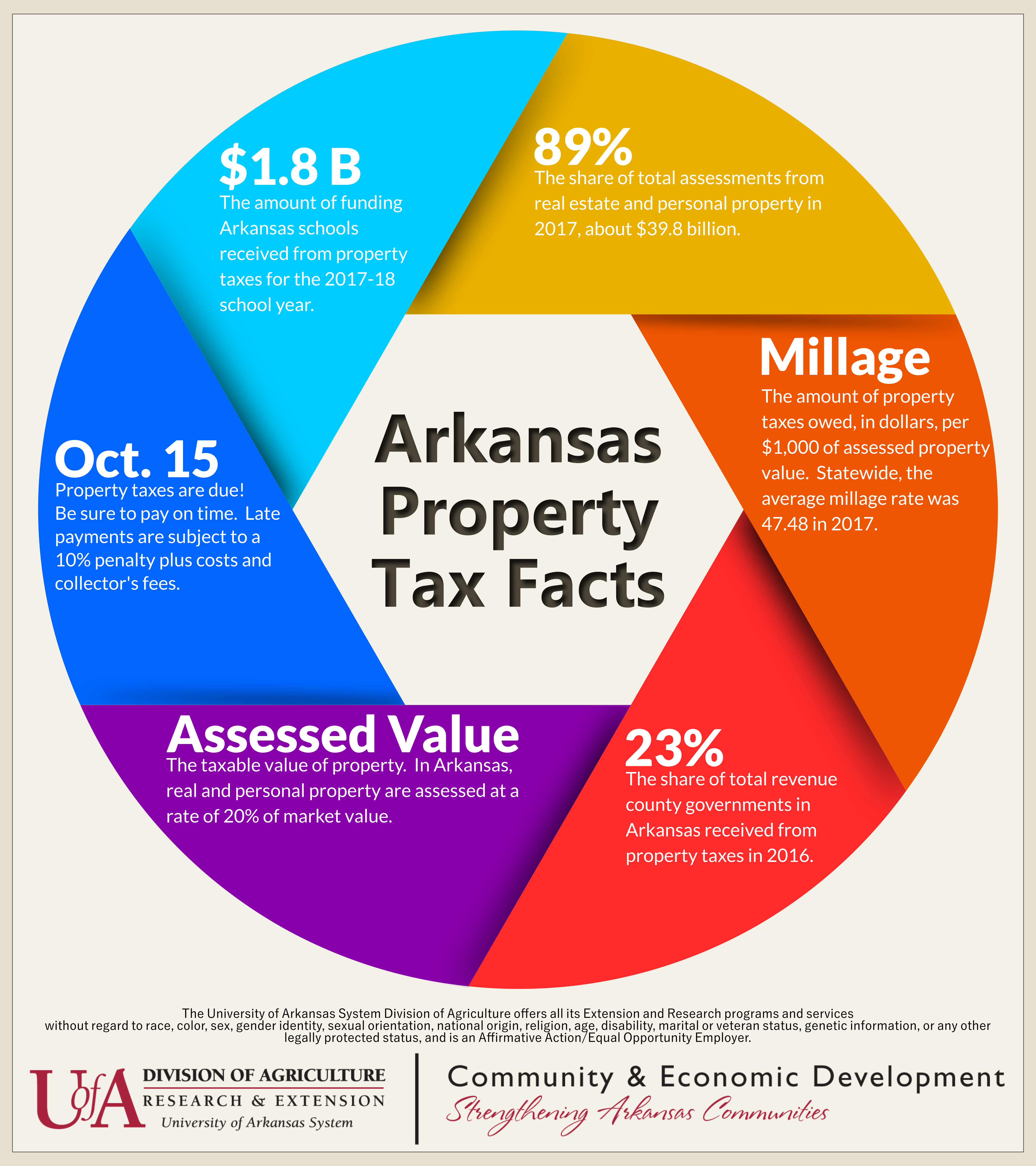

How to find out my property taxes. Your area’s property tax levy can be found on your local tax assessor or municipality website, and it’s typically represented as a percentage—like 4%. To estimate your real estate taxes, you merely multiply your home’s assessed value by the levy. This online service is offered free of charge.

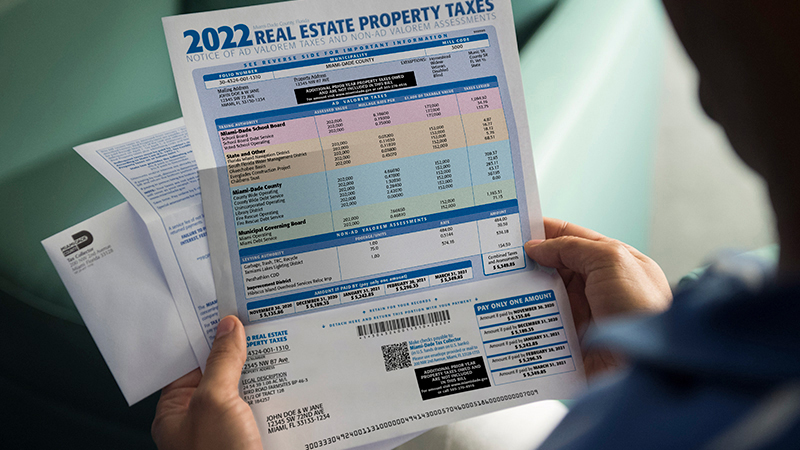

Record a deed or other document. When a property is sold in a tax sale, the delinquent owner has a redemption. Property taxes are usually collected by the county tax recorder based on information.

The treasurer's office mails out real property tax bills only one time each fiscal year. How to challenge your assessment. So if your home is worth $200,000 and your.

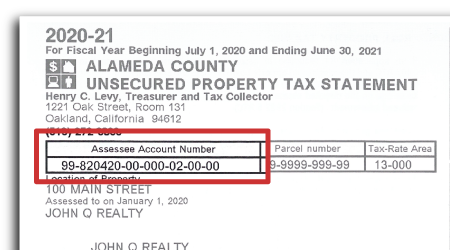

Unsure of the value of your property? 1 day agoto be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross income must be $500,000 or less if filing jointly. Check box 10 (other) on form 1098 from your mortgage company review your bank or credit card records if you paid the property/real.

Get a copy of a deed or other recorded document. Please contact your county treasurer's office. How do i find out what my property taxes are?

Find records by address on propertyrecord.com. Property tax returns and payment. How to find out if taxes are owed on a property redeeming a property after a tax sale.

.png)